Tool for creating valuation reports using the Direct Capitalization method

Fill in the data entry form and receive a detailed valuation report in your email. The tool we have developed guides you to the correct completion and automatically performs all the calculations based on the data you enter to calculate the value of the property under valuation.

STARTInformation on the Direct Capitalization Method for real estate appraisal

The Direct Capitalization Method is a theoretically simple process that is widely used in the valuation of asset market value. Market Value, according to European Appreciative Standards: “The estimated amount for which the property should exchange on the date of valuation between a willing buyer and a willing seller in an arm’s length transaction after proper marketing wherein the parties had each acted knowledgeably, prudently and without being under compulsion.” Market Value is best price that the seller could receive and the best price that the buyer could achieve.

The Direct Capitalization Method aims to estimate the market value of a property based on the income that it is able to generate. That is why "Direct Capitalization Method" is applied to the valuation of investment properties.

Basic Definitions

- Direct Capitalization Method & Investment Property: According to International Accounting Standard 40 - (Investment Property) investment property is the plot or the building or part of a building or both, held by the owner or tenant, with the aim of either rents either for capital purposes or even for both of them.

- Direct Capitalization Method & Capital: It is the amount of money that has a productive value. Is the money amount that has the ability to generate money in the form of interest either through the lending process or through the savings process.

- Direct Capitalization Method & Interest: It is the money amount that is generated by a certain amount of money over a certain period of time. In other words, it expresses the cost of money or otherwise the price for its use, for a specific period of time.

- Direct Capitalization Method - Capitalization: It is the process in which the interest of each period is converted into capital.

- Direct Capitalization Method & Simple Interest: It is the process in which the interest generated is integrated with capital only once and at the end of the period during which the capital is productive.

- Direct Capitalization Method & Interest Rate: It is the cost of money in the time unit. It is expressed as a percentage through a fixed fraction on the initial capital and is the main tool for calculating interest.

Description of the Direct Capitalization Method

The Direct Capitalization Method is a rather simple or at least simpler than other known methods. According to the Direct Capitalization Method, the market value of an asset is estimated by the ratio of the income that it is expected over the period of one year, to the capitalization factor. In other words, according to the "Direct Capitalization Method" the market value of an asset is the capitalized value of the income that the property is expected to generate over a year. The main assumption that is adopted to the "Direct Capitalization Method" is the assumption that the annual income, is to be paid in perpetuity.

Direct Capitalization

Direct Capitalization Method is based on the theory of simple capitalization, in which, the amount of interest generated over a period of one year is integrated once, at the end of that year, in the initial money amount.

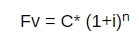

The procedure of calculating the future value (Fv) of initial capital(C) which is repaid at an annual interest rate(i) after n intervals, shall be calculated by the following equation:

(1+ i)n is called a capitalization factor.

By multiplying capital (C), by a Capitalization Factor (1+i)n we calculate its value after n periods.

By dividing capital C, by Capitalization Factor (1+ i)n we calculate its value for -n periods.

Direct Capitalization Method Stages

- Determination of the market monthly rent of the property

- Calculation of the projected annual income

- Select of the capitalization factor

- Calculation of the market value of the property

Before analyzing “Direct Capitalization Method”, it would be useful to identify the cases where the "Direct Capitalization Method" may be preferred to other Methods.

Whether valuer chooses the "Direct Capitalization Method" or not, is characterized by the subjective element of the valuer's personal judgment. Moreover, it is common, the data to serve not only "Direct Capitalization Method" but other methods also. In such cases, the valuer is asked to choose the method to use, taking into account the specific characteristics of the property, the purpose of the valuation as well as other special circumstances. Moreover, there are few times when valuer chooses to use "Direct Capitalization Method" in combination with an other method.

However, the cases where the use of the Direct Capitalization Method is appropriate, are the following:

- Direct Capitalization Method is used when the property is rented and the monthly rent, is at market levels. If the property is rented at either lower or higher rent, it should be not taken into account it in order to determine the market monthly rent.

- Direct Capitalization Method is used when the property is rented under normal lease terms. This factor is importance, in case of commercial assets, where the terms of the lease often include clauses which affect his future income.

* Direct Capitalization Method is used even if when the asset is empty but it could be leased at normal rent and without special lease conditions.

- Direct Capitalization Method is used when the asset is in a stable market. it is extremely important the valuer to take into account special local market circumstances. An economic environment which is not expected to fluctuate strongly in the near future is a necessary condition for the implementation of the Direct Capitalization Method.

- Direct Capitalization Method is used when the asset is located in a market which is characterized by sufficient number of comparative data. A local market, which is characterized by a high number of transactions, with secured access to these data, or sufficient number of available for sale and rent assets is a prerequisite for the Direct Capitalization Method.

- Direct Capitalization Method is used to estimate the value of properties, whose condition of maintenance is considered at least good. This is because, as mentioned above, a basic assumption in this method is that the rental yield is done in in perpetuity. As a result a property with a long useful life, is indicated for the application of the Direct Capitalization Method

- Finally, Direct Capitalization Method is used to estimate the value of properties which are located in areas, characterized of insignificant chances of change that would lead to a change in their annual income. For example, the prospect of the redevelopment of an area means a fall in commercial rents, during the period of work performed, where commercial traffic is usually limited, but also a rise in their rents after the project is completed.

It would be said, that "Direct Capitalization Method" is appropriate when future income of the property is considered stable, or at least, when there are no obvious reasons which may lead to a significant change.

Application: Direct Capitalization Method

Direct Capitalization Method & Annual Income

The difference between "Direct Capitalization Method" and others Capitalization Methods is that "Direct Capitalization Method" estimate the Market Value of the asset, based on future income over a single year.

The income that a property can generate can come either from rents or from the business activity it serves and with which it is inextricably linked. In practice, the Direct Capitalization Method is mainly applied to the assessment of the market value of real estate which ensures future income, through its lease. For this reason, the Direct Capitalization Method is often referred to as the Lease Method.

It is undeniable that market-based valuation is based on real market conditions. Inevitably, during the implementation of the Direct Capitalization Method, we refer to its research, in order to determine a representative market monthly rent.

Direct Capitalization Method is used, particularly, to assets that secure future income through their rental. Given that "Direct Capitalization Method" is based on market value, market research is necessary in order to estimate it’s annual income based on monthly rents of comparable properties. Where 'Direct Capitalization Method' is used without but there is not sufficient number of similar comparative data, the valuer has to record the differences observed and to reflect them through the necessary adjustments to monthly rents in order to be to reflected at the price of the final market monthly rent to be used.

Direct Capitalization Method & Capitalization Rate

The most difficult stage in "Direct Capitalization Method" is to choose Capitalization rate. Capitalization rate which will be chosen has to reflect market conditions and all potential risks not only at the valuation date but also at future.

The success of all of the above, depends on the valuer’s experience and ability to identify the special characteristics of the property as well as his ability to identify the trends and changes of the social, economic and political environment.

It could be said, that risks should be taken into account in "Direct Capitalization Method" are categorized, in risks arising from the lease, risks related to the type of property, risks arising from property’s construction, risks that can be attributed to possible changes in legislation, possible changes in taxation, possible changes in property’s area and finally to risks arising from economic environment.

More specifically, we could say that:

- Direct Capitalization Method - Capitalization rate and risks arising from the lease. This category includes risks such as the intention of tenant not to pay rents or his inability to serve this obligation and risk of his non-compliance with building rules regulation which probably lead the earlier removal of the property. Finally, includes risk that arising from the agreed end of lease which probably leave the property empty for a period of time.

- Direct Capitalization Method - Capitalization Factor and risks arising from the type of property. Each type of property reacts differently to the social and economic conditions and presents a different degree of risk. For example, nowadays, an apartment in the city of Thessaloniki presents a much lower degree of risk in terms of its lease, than an office, as the chances of being vacant could be characterized as the minimum. At the same time, an office is more resistant to changes in the external environment than a hotel, which is considered more risky.

- Direct Capitalization Method - Capitalization rate and construction risks. The risks arising to the property’s construction are mainly attributed to its construction failures, which can lead both to limited use and to a faster depreciation.

- Direct Capitalization Method - Capitalization rate and legislative risks. There are risks arising to changes in legalization in relation with commercial and residential leases. Such changes may either prevent the removal of the tenant, favor the extension of his stay or facilitate the unilateral end of lease.

- Direct Capitalization Method - Capitalization rate and tax risks. The risks arising from tax changes such as increase in tax property, increase in in income tax derived from rents and generally not only any increase in existing taxes but also the possible future imposition of new property taxes leading to a reduction in net incomes they generate.

- Direct Capitalization Method - Capitalization rate and urban planning risks. Risks of changes related to the urban planning of the area are mainly linked with changes that modify the use of the property.

- Direct Capitalization Method - Capitalization rate and financial risks. Financial risks are considered to be changes in inflation as well as interest rates. However, in 'Direct Capitalization Method' these risks are reflected indirectly through the changes in the prices of monthly rents and market sale prices of properties. For this reason, the 'Direct Capitalization Method' is often called, as method of indirect inflation. This category could include changes in consumer behavior that turn public preferences on specific properties reducing their rate of return. A typical example is the practice of short-term rental of residential properties. As long as apartments rented by day, were more preferable than hotel rooms, long-term rental prices were increased due to increased demand. As a result, better returns were achieved.

When using the Direct Capitalization Method, special attention should be paid to the sizes in which the appraiser will base his estimate. If available comparative data are gross monthly income then you should also choose a capitalization rate based on gross prices.

When Direct Capitalization Method is used it is important to remember that capitalization rate expresses danger. This means that a higher risk is equal to a higher capitalization rate which means lower market value.

Direct Capitalization Method: Practical Use

Direct Capitalization Method is based on the following formula: V=I/Y

Where V is the asset’s market value, Ι is the annual market income, Y is the Capitalization rate

Direct Capitalization Method example Νο.1

Apartment built in 2000 at the west side of Thessaloniki city, Market rent 400€/ month, Capitalization rate 6%

The market value of the property through the "Direct Capitalization Method" is calculated below:

V= 400*12/0,06 => V=4.800/0,06 => V= 80.000€

Direct Capitalization Method, example Νο.2

Groundfloor store at a commercial street where the Capitalization rate of commercial assets in that area, is estimated at 8%. Due to a construction failure use of asset is limited. Market rent in the area 1200€/month.

The value of the property through the "Direct Capitalization Method" is calculated below:

V= 1200*12/0,09 => V= 14.400/0,09 => V= 160.000€

Higher capitalization rate reflects the fact of limited use due to it’s construction.

Direct Capitalization Method, example Νο.3

Ground floor store in commercial square whose redevelopment will be completed next month. Market rent in the area is estimated at 1500€ /month and yield of commercial ground floor stores in the wider area, is currently estimated at 8%.

The market value of the property through the "Direct Capitalization Method" is calculated below:

V= 1500*12/0,07 => V= 18.000/0,07 => V= 257.142€

The lower return is due to the location of the property – in a commercial square including its upgrade.

Direct Capitalization Method, example Νο.4

Commercial asset which is consisted of ground floor of 35sq.m and loft 35 sq. m. also. Market rent is 6€/sq.m (Ground floor meters). estimated at 40% of the ground floor meters. Yield 9%

The value of the property through the "Direct Capitalization Method" is calculated below:

Loft 35sqm*0,4= 14sqm, Total area: 35 14=49sqm

V= 49*6* 12/0,09 => V= 3.528/0,09 => V=39.200€