Tool for creating valuation reports using the Discounted Cash Flow (DCF) method

Fill in the data entry form and receive a detailed valuation report in your email. The tool we have developed guides you to the correct completion and automatically performs all the calculations based on the data you enter to calculate the value of the property under valuation.

VALUATION FORM FOR ASSETS VALUATION FORM FOR HOTELSInformation on the Discounted Cash Flow (DCF) method for real estate appraisal

The discounted cash flow (DCF) method is a valuation method designed to:

- Determining the profitability or the simple viability of an investment that may relate to a business or property.

- Examination of future earnings or projected cash flows from this investment.

- In the cash flow discount to calculate the estimated present value of the investment (the estimated current value of the investment will usually be referred to as net present value or NPV-Net Present Value).

Basically the discounted cash flow (DCF) method attempts to calculate today the value of a business or asset, based on projections of how much money it will generate in the future. This is one reason why the discounted cash flow (DCF) method is considered quite reliable in terms of the financial aspect of an investment.

For the application of this method the valuer should be aware of some factors that affect the investment and are directly related to the DCF method, these factors are:

- Initial construction cost of the property

- Annual maintenance and operating costs of the property

- Annual income generated by the property

- The length of time that the investment will last (it should be noted that according to the literature on commercial real estate their investment life varies from 5 to 15 years)

Essentially the above elements are also the data that the appraiser must know in order to be able to apply the discounted cash flow (DCF) method.

The ultimate goal of DCF analysis is to calculate the money an investor will receive from an investment, adjusted to the time value of money. The basic assumption that all economists use in terms of the value of money is that a currency unit today is worth more than the same currency in the future, so applying this assumption is therefore heavily based on the reliability of the discounted cash flow (DCF) method.

A useful term with regard to the discounted cash flow (DCF) method is the useful life of the property, according to the EVS 2016 standard the useful life of a property is the period during which the property will be able to used and to make a profit to the investor, knowledge of the useful life of the property is a very important factor that the appraiser should know in order to properly apply the discounted cash flow (DCF) method.

Advantages and disadvantages of the discounted cash flow (DCF) method

Advantages of the DCF method (+)

- The key advantage in applying the discounted cash flow method is the accuracy and realism of the estimate as it takes into account the time value of money, that is, the assumption that a currency is more valuable today than in the future.

- Another advantage of the DCF method is that it is applied without the use of comparables, that helps the appraiser to estimate the value of a property located in a market where there are no such properties, therefore the discounted cash flow method (DCF) has been mentioned that is best applied to larger commercial real estate properties.

Disadvantages of the DCF method (-)

- One of the difficulties in applying the discounted cash flow (DCF) method is that it requires quite good knowledge of the economic conditions in the real estate market in the area where it is applied.

- Another difficulty in applying the DCF method is its complexity in determining the correct discount rate to be applied to the method

- Another major disadvantage is that the DCF method often relies on the expected profits that a property will generate quite often, so there is the element of uncertainty at many cases.

It can be seen from the above that the application of the discounted cash flow (DCF) method has both advantages and risks for the valuer to bear in mind.

Implementation steps of Discounted Cash Flow (DCF) Method

To apply the discounted cash flow (DCF) method, there are a few steps that are:

- Clear separation of the time periods for applying the DCF method

- Calculation of the revenue generated by the investment over the implementation period

- Calculate the costs of the investment over the implementation period

- Final calculation of the value of the property by the following formula of DCF method

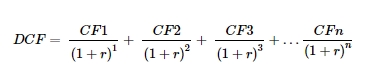

The basic formula used in the discounted cash flow (DCF) method depending on the period to be applied is:

Where: CF = cash flow/year and r = discount rate

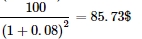

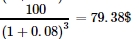

For example, it is calculated using the DCF method what would be the value of an investment today that would generate an annual income of $ 100 at an 8% discount rate.

Present value of revenue for 1st year

Present value of revenue for 2nd year

Present value of revenue for 3rd year

As observed according to the DCF method, at present value the investor does not profit from the $ 300 investment but $ 257.71, that is the value of the investment today.

This is because this DCF method is based on the assumption that $ 300 today is worth more than $ 300 next year.

Discount rate (r) on discounted cash flow (DCF) method

The discount rate is a key component in applying the discounted cash flow (DCF) method, because the discount rate is essentially what reduces the value of future cash units that the property will bring to its present value. However, its definition is quite complex and requires the valuator to have sufficient knowledge of economics. For the convenience of the calculations, as found from the literature, the discount rate to be applied to the DCF method is calculated as follows:

r = Capitalization Ratio + Annual Change in Market Values - Annual Depreciation Rate

It should be noted that the discount rate is usually the desired or expected annual rate of return on the property, so the higher the investment risk, the higher the discount rate applied to the DCF method, according to the international literature the discount rate’s value for investment real estate ranges from 6% to 12%.

Example of using the discounted cash flow (DCF) method on real estate investments

An investor could determine the discount rate of the DCF method equal to the return they expect from an alternative investment of similar risk. For example, $ 500000 could be invested in a new home that is expected to be able to sell in a decade for $ 750000. Alternatively, $ 500000 could be invested in another investment where it is expected to repay 10% annually for the next 10 years.

It is assumed that the cost of substituting the rent or the tax implications between the two investments is not included. Thus, all that is needed for DCF analysis is the discount rate (10%) and future cash flow ($ 750000) from future home sales.

After calculating the discounted cash flow (DCF) method, in this example DCF analysis shows that future home cash flows are currently $ 289157.47. Therefore it is not in the interest of the investor to invest in it according to the results of the DCF method. The second investment, which will return $ 500,000 over the next decade, offers better value. However once the tax implications are included, rentals and other factors will find that the effect of the DCF method is a little closer to the current home value.

In conclusion, the discounted cash flow (DCF) method is a very good financial and valuation tool for estimating the value of commercial and investment real estate. In the DCF method, however, the valuer or practitioner must have studied it well enough and be aware of it in order to avoid its pitfalls and obtain reliable results through the discounted cash flow (DCF) method.